Blogs

The knowledge you’re looking for

Why waste time in front of your computer endlessly scrolling through pages of irrelevant content? If you can find a single resource with the necessary answers, why look further? Our online blog aims to give you the valuable information you seek.

Has Your Customer Stopped Making Payments

Non-payment by clients is an all-too-common challenge in the construction industry. Delayed or missing payments can disrupt your cash flow.

Why Construction Companies Overspend on Overheads – And How to Fix It

Struggling with unpredictable overheads in your construction business? Learn why a 12-month forecast is essential to staying in control of your costs.

Run Your Construction Business Like You’re Going to Sell It (Even If You’re Not)

Whether you plan to sell your construction business in five years or never, here’s a hard truth: The most valuable businesses are the ones that don’t rely on their owner.

Why “Turnover is Vanity, Profit is Sanity, and Cash is King” Misses the Point

Why “Turnover is Vanity, Profit is Sanity, and Cash is King” Misses the Point

VAT Treatment on New Builds

When working on new build residential properties in the UK, the VAT treatment of materials and labour depends on how you supply them.

IR35 in Construction: What You Need to Know in 2025

In 2025, IR35 remains a major issue for construction companies across the UK. With HMRC ramping up reviews and penalties, ensuring your construction business complies with IR35 legislation has never been more critical.

Should We Outsource Payroll in Construction?

Payroll is one of the most critical tasks in construction—but it can also be among the most complex and time-consuming. Should you Outsource Payroll.

How to Manage Holiday Pay and Pensions for Construction Workers

Managing holiday pay and pensions in construction can feel complicated—especially with fluctuating workforces, seasonal contracts, and complex employment arrangements. Yet it’s essential to get it right to avoid compliance issues, penalties, or unhappy workers.

What to Do if HMRC Reviews Your Employment Status

Receiving notice from HMRC about an employment status review can feel stressful—particularly in the construction industry, where the use of subcontractors is common. HMRC regularly checks employment status to ensure compliance with IR35, CIS, and employment tax regulations.

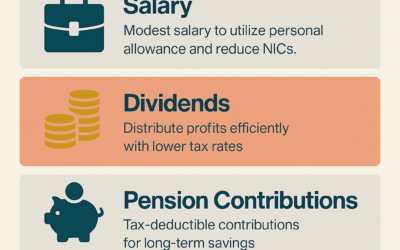

What’s the Best Way to Pay Directors in Construction Companies?

If you run a construction company, knowing the most tax-efficient and effective way to pay directors is crucial. Get this right, and you’ll boost profitability, minimise tax bills, and maximise your personal take-home income.

Growth on your mind? Let’s talk

We’ll chat about your business, your future, and your aspirations. And then we’ll help you get there.